In today’s dynamic economic landscape, achieving a sustainable financial future requires strategic planning and disciplined execution. Whether you’re aiming to build wealth, secure retirement, or simply gain financial peace of mind, adopting effective tips and strategies is essential. From setting clear financial goals and crafting a realistic budget to making informed investment decisions and managing debt wisely, each step plays a crucial role in shaping your financial journey. This article explores actionable insights to help you navigate the complexities of financial planning, ensuring that you build a solid foundation for long-term financial stability and success.

Understanding Financial Goals

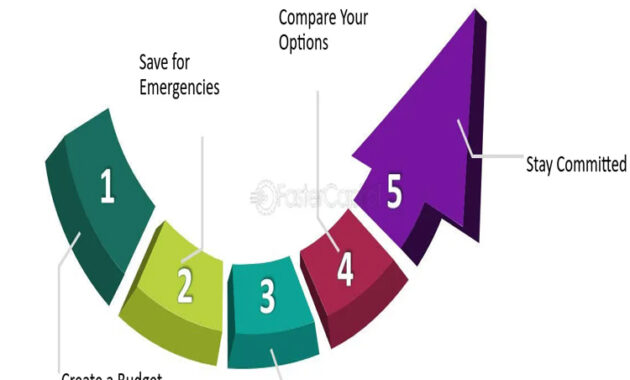

Setting and understanding financial goals is the cornerstone of creating a sustainable financial future. Financial goals provide direction and purpose to your financial planning efforts, guiding decisions on saving, investing, and spending.

Setting Clear Objectives

Start by setting clear, measurable, achievable, relevant, and time-bound (SMART) goals. These can range from short-term goals like building an emergency fund or paying off debt, to long-term goals such as saving for retirement or purchasing a home. Clear objectives help you prioritize where to allocate your financial resources effectively.

Prioritizing Goals

It’s essential to prioritize your financial goals based on your values and current financial situation. Some goals may take precedence over others, depending on factors like urgency, importance, and feasibility. By understanding the hierarchy of your goals, you can focus your efforts and resources on achieving them systematically.

Budgeting for Stability and Growth

Budgeting plays a crucial role in attaining financial stability and nurturing sustained long-term growth. It involves creating a plan for your income and expenses, ensuring that you manage your money effectively to meet both short-term needs and long-term financial goals.

Creating a Budget

Start by assessing your income sources and listing all necessary expenses, including bills, debt payments, groceries, and savings contributions. Allocate a portion of your income to each category, ensuring that your total expenses do not exceed your total income. A well-crafted budget provides clarity on where your money goes and helps you avoid overspending.

Tracking Expenses

Monitoring your spending habits is crucial for maintaining budgetary discipline. Keep a record of all expenditures, whether through apps, spreadsheets, or traditional methods, to identify areas where you can cut back or reallocate funds. Tracking expenses enables you to make informed financial decisions and adjust your budget as needed to stay on track towards your financial goals.

Building Emergency Savings

Building emergency savings is a crucial aspect of financial planning that provides a financial safety net for unexpected expenses or income disruptions. This process entails allocating funds specifically reserved for emergencies, guaranteeing readiness to manage unexpected financial hurdles without relying on high-interest debt or diminishing other savings.

Importance of Emergency Funds

Emergency savings serve as a buffer against financial emergencies such as medical expenses, car repairs, job loss, or home repairs. Having a designated fund allows you to cover these expenses without disrupting your long-term financial goals or resorting to borrowing at unfavorable terms.

Saving Strategies

Start by determining an achievable savings goal, such as three to six months’ worth of living expenses, based on your financial situation and obligations. Set up a separate savings account specifically for emergencies to prevent accidental spending. Regularly contribute to this fund, even if it’s a small amount initially, and automate savings transfers to ensure consistency.

Investing Wisely

Making prudent investments is crucial for attaining sustained financial growth over time and accumulating wealth. It involves making informed decisions about how to allocate your money in assets that have the potential to generate returns over time, while considering your risk tolerance and financial goals.

Types of Investments

Understanding different types of investments is crucial. These may include stocks, bonds, mutual funds, real estate, and alternative investments like commodities or cryptocurrencies. Each type of investment carries its own risks and potential rewards, and diversifying across different asset classes can help manage risk.

Long-Term Growth

Investing with a long-term perspective allows your investments to compound over time, taking advantage of the power of compounding returns. This means reinvesting earnings and letting them generate additional earnings over time, accelerating wealth accumulation.

Risk Management

Assessing and managing risk is integral to investing wisely Sustainable . Determine your risk tolerance—the amount of risk you are comfortable taking based on your financial goals and timeline. Balancing risk and return involves choosing investments Sustainable that align with your risk tolerance while also considering potential market fluctuations and economic conditions.