Financial planning for beginners is easy for you to do. With just a little practice and coercion, you can have good financial planning.

For starters, you can start with the little things. Such as setting aside pocket money or monthly money, collecting small change, and making a list of primary needs.

3 Financial Planning for Beginners

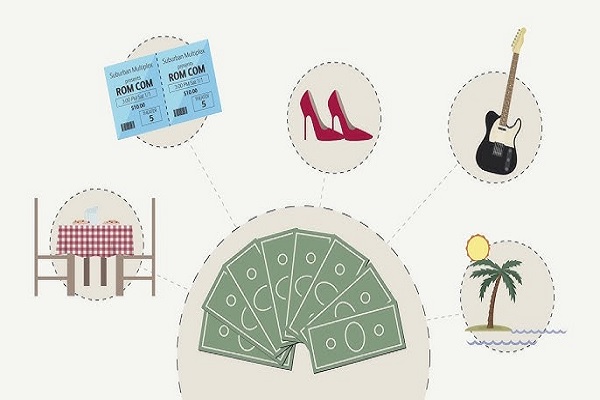

For a beginner, planning and managing finances is not an easy thing. Resisting the desire not to be extravagant is quite a difficult problem. Here is some financial planning for beginners that you can apply.

1. Begin by Thinking of the End

The first step you can take is to take time to think about the ending. Most people wake up every day to go to work or do their regular activities.

Rarely does anyone take the time to think about the reasons and goals they work for? It’s not enough just to know and understand your expenses and income.

You need to have a vision of what you want in life. That way, you can work with clear goals.

2. Setting Financial Goals

The next financial planning for beginners, namely setting financial goals. Having a financial plan is a very good thing.

However, this financial plan can end up in vain if you don’t have clear financial goals. In other words, the financial plan must align with the financial goals.

Making a financial plan is not as complicated as it seems. Your point of money view is what is used as a reference for preparing a financial plan.

For example, you are raising money to buy a house. Raising money to help you when you reach retirement age.

With goals like these, you will get the compulsion to save. Your financial goals can be used as motivation.

Ask yourself, in five years what do you want to be? What about in 10 and 20 years?

Do you want to buy a house, car, or apartment? Maybe you want to get out of debt soon if you have one.

If you have a concrete goal, identifying and completing the next steps will be easy. When working, you can be motivated to immediately realize your financial goals.

3. Understand Your Monthly Cash Flow

Don’t let your money just roll in and out. Having an accurate picture is key to financial planning.

In addition, you can also reveal ways to direct more money into savings. Seeing where the money is going can help you develop a plan in the short, medium, and long term.

Financial planning for beginners can help you improve your standard of living for the better. Therefore, don’t wait any longer and get started right away.